Even the most charismatic heros are destined to be supplanted by their more stable, if droll, contemporaries. This seems to be hard-boiled into our human destiny. Agamemnon and Achilles were replaced by their less flamboyant counterpart, Odysseus; the fiery promise of fossil-fuel technologies are now being phased out by the boring, reliable and simple electric motor. It’s the same play being performed on different stages with a different cast. In that vein, one of the most recent dramas can be seen in the spectacular rise and fall of Bitcoin.

If you’ve been following Bitcoin over the past six months, it may feel like like the hero is now stumbling down a dark alleyclutching a mortal wound and too preoccupied with applying pressure to see all the “dead end” signs. There are certainly some bitcoin investors feeling that way. Stories abound of people taking out high-interest loans and second mortgages to get in on what was sold as a once-in-a-lifetime investment opportunity toward the end of 2017.

Those unfortunate souls pumped untold billions of dollars into the trending cryptocurrency by purchasing bitcoin tokens. In January 2017, this was an industry valued at over $830 billion. Ten days later, that number dropped over $360 billion, and nobody knows why.

Now, as the predicted crashes in bitcoin’s value are manifesting, all may seem lost. But like any good drama, there’s a twist. It appears that bitcoin was not the star after all. It is its underlying technologysomething known as the blockchainthat deserves attention.

The blockchain is the ledger system that makes bitcoin such a powerful idea. In addition to its influence on global finance, blockchain promises to upend everything from accounting and project management, to cybersecurity and the insurance industryand everyone, from your neighbor to the Chinese government seems to be involved, somehow.

BLOCKS ‘N’ BITS

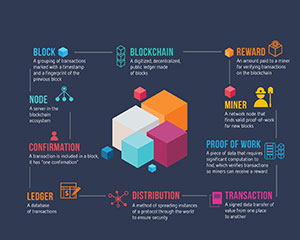

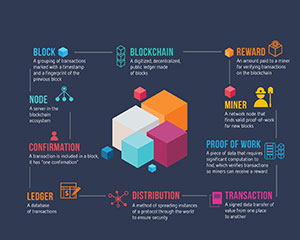

The blockchain is a distributed ledgersimilar to the kind the accounting department at work uses to track incoming and outgoing expenses. Originally, ledgers were kept in actual books, then they moved to computer programs like Excel and Quickbooks. Then the internet came along.

The blockchain is an electronic ledger that lives on multiple servers all over the globe. These ledgers are open to anyone and, because of this, it is difficult to change any data recorded on the blockchainor cook the books, as they saywithout raising red flags.

Every server carries the full ledger, so there is no central authority managing the chain. Because it is not tied to a state government, the blockchain is ideal for facilitating cross-border tradeboth as a means of tracking the movement of goods and services, and as a platform upon which to build a cryptocurrency, like Bitcoin.

Bitcoin is known as a cryptocurrency because it draws its inherent value from a cryptographic algorithm. An individual bitcoin is essentially the solution to a complex math problem. There are a finite number of solutions to be drawn from the bitcoin algorithm, and solving these problems involves serious computing power.

As such, those who use their own machines to solve these equationsminersare rewarded with bitcoins or other digital tokens for their solutions. This incentivizes the mining process and encourages more people to join the system.

For true believers, bitcoin represents the first sparks of a global revolution that will democratize wealth, the internet and society as a whole. In theory, the underlying technology that bitcoin uses to store its datathe blockchainhas the power to decentralize all online information, storing it in cryptic jumbles across the hard drives of millions of computer users, freeing us from the tightening grip of greedy banks, monopolizing tech giants and overeager governments.

Still, skeptics see little more than a bubble fueled by wild, irrational speculation and hucksters pushing get-rich-quick schemes. At the moment, it would seem that the bitcoin skeptics have been vindicated. The cryptocurrency was exchanging for nearly $20,000 on Dec. 16, an astonishing feat for a value system created practically out of thin air. Since then, the price has tumbled, dipping below $7,000 in early February. It currently sits at $9,282. It’s doubtful that number will be current by the time you pick up this paper or read this article online.

But whatever blockchain’s value at the end of any given day, one thing is certain: a global system that verifies transactions through a distributed, decentralized networkone that is internally incentivized to be fast and accurateis incredibly valuable.

That’s because the majority of our lives have to do with verified or verifiable data, whether that information lives in a formal ledger or exists as an informal tally in our heads. Beyond all our financial transactions, there’s our energy and data usage, our communications, time spent on jobs and countless other exchanges that happen explicitly or in the background of our lives.

That’s why the topic of blockchain and its many uses kept popping up at China’s biggest political event last week (the National People’s Congress and Chinese People’s Political Consultative Conference). Outside of food, shelter and water, accounting is the other major necessity of modern humans. It’s vastly more significant than any other technology we possess. In fact, all other technologies begin with an attempt to increase accounting efficiencies. A few examples include the internet, banking, trade, metallurgy and roads.

APPLICATIONS

Finance people love the blockchain. Accountants, in particular, are absolutely smitten with its potential. Instant auditability, legal proof, contract verification and an immutable audit trail are just some of the buzzy catchphrases accountants mutter in their sleep. Blockchain promises to make their vet dreams a reality.

This is why Josh McIver decided to start ULedgera blockchain-based accounting companyinstead of continuing with the so-called Big Four (Deloitte, PwC, EY, KPMG). That’s understandable. If Robin Hood ever got his hands on a rifle, he’d probably put his bow and quiver down, too. McIver is certain that the technology he and his team are developing will become the future of enterprise auditing.

According to McIver, his technology “helps companies assert and prove the integrity of their data.” That’s no small feat. Today that proof of integrity is the responsibility of hundreds of thousands of accountants. ULedger promises efficiency, auditability, legal proof of contractual obligations and immutable audit trails so “anytime that a company has data that needs to be proven in some manner, or when other people make decisions based on that data, they can use ULedger to authenticate or certify the integrity of that data.”

Right now, the city of Boise, Idaho, is using the technology to help streamline utility payment responsibilities between home buyers and sellers, a once-tedious task that tied up valuable city resources.

There are thousands of blockchain applications in the works. Most of them are built using Ethereum (a foundational blockchain technology that simplifies the development of how the blockchain stores data). All of them promise to change the world. The majority will disappear into the ether (or ETH, which is what the Ethereum token is called), but some will endure and persist. It’s difficult to wade through the white noise. It helps to have a guide.

One such Sherpa is Chris Groshong, a biochemist turned blockchain enterprise expert who now heads the blockchain consulting firm CoinStructive. If you don’t have the patience to dig through all the pre-sales and initial coin offerings (ICOs), find a Groshong to help you understand what does what and how.

According to the expert, this next generation of blockchain companies affect a broad spectrum of markets. Get comfy; this ride will take you from banking, through alternative energy and end with a digital feline that’s worth as much as a stake in a hypercar (the rarest and most expensive of super cars).

POWER TO THE PEOPLE

Beyond financial tools, there are the day-to-day things like electricity. As much as the current administration would like to bolster the old ways of creating power, everyone knows that sustainable sources such as solar, wind and hydro are the way to go. That’s where Dan Bates and Impact PPA comes in.

Bates is a veteran of renewable energy and a pioneer in blockchain. His idea is simple: He installs solar and wind farms around the world and lets people buy the power they need. He’s installed his power plants in 35 countries. So, why is Bates investing in developing a blockchain technology and token? Most notably, he works in troubled, developing locations.

The “PPA” in Impact PPA stands for “power purchase agreement.” Bates wants everyone to have the ability to invest in the empowerment of disenfranchised peoples across the globe.

Traditionally, the financing of power grids has been the responsibility of the government. But what if there is no local government that can finance that? Sure, we have global banking institutions that can handle that, but Bates’ question is: “How do you get over that financial [and bureaucratic] bottleneck, which is presented by the likes of the nongovernmental organizations out there, or the World Bank, USAID, Power Africa?”

The way to solve that, according to Bates, is to get a group of manufacturers, installers and local leaders to commit to a PPA and sell the tokens on the blockchain to people who Bates thinks are, “interested in social good, they’re interested in the effects of climate change, and how to mitigate those effects and want to put their money into something that will have a positive impact on the planet.”

As with all blockchain technologies, those who invest early will have the greatest potential for profit. Impact PPA’s power token is called GEN, it allows people who live around Impact PPA’s power stations to buy as much energy as they need. The MPQ token pays for building the renewable energy power plants and lets anyone around the globe invest.

Bates’ team is currently rebuilding the west coast of Haiti. The first of 42 cities is Les Irois. He’s doing this even if no one buys his blockchain token. Bates hopes to accelerate global access to renewable energy through the blockchain’s ability to let people invest in a transparent way.

FUNNY MONEY

Collectible. Breedable. Adorable. Start meow!

When you develop a blockchain technology you really want adoptability, scalability and value. That means your technology is easily used, by a lot of people, who will pay a lot for it. As tempting as instant auditability, reliable verification of contracts and global deployment of community-funded renewable energy sound … who doesn’t like cats?

CryptoKitties are digital cats that straddle a version of the blockchain that contains all their digital kitty DNA. Owners store their binary felines in digital wallets, like any other cryptocurrency, but they can also breed their kitties with others. That’s how new kitties are released. When CryptoKitties breed, their DNA is mixed to produce the new generation block and that is added to the blockchain.

You purchase CryptoKitties with Ether (ETH). Normal kitties will set you back fractions of one token, where as the exclusive varieties can cost several hundred tokens. As Ether hovers around $700 a token, the asking price of some CryptoKitties can reach north of $535,000 (that’s almost a studio apartment in San Jose).

For those who are tired of traditional methods of earning enough money to live in Silicon Valley, like inventing the next disruptive technology or becoming the head of a cartel, CryptoKitties may provide a reasonable way to maintain some degree of stability.

If kitties aren’t your thing, and you prefer something more stable and realistic like a hyper-car (a very rare super car), check out Bitcar where you can buy a part of something like a Bugatti Chiron. Not only will you be able to chuckle confidently at the schmuck pulling up in the Lamborghini Gallardo, but you can also sleep safely in the knowledge that your hard-earned cash is safe, somewhere where the Chiron is garaged, in Dubai or Doha or Vladivostok or Tokyo maybe. Anyway, wherever it is, as long as your wallet is safe and secure, it’s basically in there.

CRYPTO CRITICS

One of the most visible thought leaders involved with bitcoin and blockchain is Roger Ver. He’s an early adopter of bitcoin, and very influential in the space. Bitcoin has made Ver very wealthy, but he’s not satisfied with what the Bitcoin Core technology has become.

“By the end of the year, Bitcoin Core will no longer be the dominant crypto,” is a prediction of Ver’s that seems to be coming to fruition. He has led a push to redefine bitcoin’s functionality and structure to improve what he feels are shortcomings that should have been fixed years ago. He wants to increase transaction speed, lower transaction costs and continue what he believes are the core duties of bitcoin: a way of reliably sending money, peer to peer, quickly, cheaply and with a good amount of anonymity.

Around Aug. 1, everyone holding Bitcoin Core (BTC) in their digital wallets received an equivalent amount of Bitcoin Cash (BCH), a new cryptocurrency that continues what Ver and other early bitcoin adopters feel is the original mission of bitcoin. This has earned Roger a place among the most influential voices around.

His battle cry, “#BitcoinCash is what I started working on in 2011: a store of value AND means of exchange,” is an echo of what Gavin Andresen (one of the first developers of Bitcoin Core) said in 2010. The two carry a lot of influence, which has propagated Bitcoin Cash across the globe.

Right now the biggest problem with Bitcoin Core (the original iteration of bitcoin) is that it’s not only slow and expensive, it’s incredibly volatile. A solution to the volatility problem is Kowala (KUSD) a token that’s fast and cheap that is pegged to the U.S. dollar. Why would someone want a cryptocurrency that always equals the dollar when dollars already exist? To simplify the cryptocurrency process for users.

“Our mission statement is to remove the obstacles to mass adoption,” Kowala co-founder Eiland Glover says.

Removing volatility, expense and latency is certainly an improvement over Bitcoin Core, but where is the sweet payoff for eager investors looking for rapid tenfold returns? At face value, this just sounds like a good way to pay for products and services with a decentralized token. Who wants that?

It turns out that a lot of people want that. The search for a reliable and stable cryptocurrency is still on. It’s what Bitcoin Core was supposed to be before things got out of hand. Kowala’s team has developed a unique algorithm that serves as its backbone. To maintain an equivalent value to the dollar, Kowala’s system either mints or purchases and destroys KUSD tokens. Investors can purchase a part of the network and its mining ability by purchasing MUSD tokens.

The constant minting or destruction of tokens ensures that KUSD is secured by the value of work being done on the network. Every transaction pays a small fee to the verifying miner, and that fee across all transactions is the work that stabilizes the system. It’s as if your sweat and toil was the stabilizing factor for the currency in which you’re paid.

What’s exciting is that anyone can create their own token and design their own blockchain, and anyone can invest during the early stages for very little. New blockchain technologies are funded by presales and initial coin offerings (ICOs) that are open to the public. The winning technologies will pay exponential dividends to their early investors. Just like in the dot-com days, you can employ a Wall Street trader or a local fortune teller to find the best use of the technology; either one will be just as good. Just don’t get roped in like the suckers in the late ’90s who bought pieces of a Beanie Baby trading site or invested in a server made of Legos.

Just kidding. That was eBay and Google.

John Flynn contributed to this story.