home | north bay bohemian index | news | north bay | feature article

Robby Davis

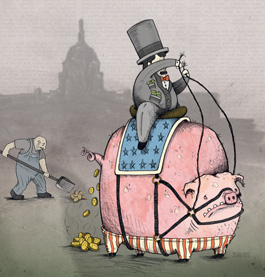

CLEANING UP: Breaks, cuts and loopholes have tipped the scales so far that many top corporations pay no taxes at all.

Trickle-Down Trouble

The tax facts that fall through the cracks

By David Cay Johnston

For three decades, we have conducted a massive economic experiment, testing a theory known as supply-side economics. The theory goes like this: lower tax rates will encourage more investment, which in turn will mean more jobs and greater prosperity, so much so that tax revenues will go up, despite lower rates. The late Milton Friedman, the libertarian economist who wanted to shut down public parks because he considered them socialism, promoted this strategy. Ronald Reagan embraced Friedman's ideas and made them into policy when he was elected president in 1980.

For the past decade, we have doubled down on this theory of supply-side economics with the tax cuts sponsored by President George W. Bush in 2001 and 2003, which President Obama has agreed to continue for two years.

One would think that the question of whether this grand experiment worked would be settled after three decades—that the practitioners of the science of economics would look at the data and pronounce a verdict, the way Galileo and Copernicus did when they showed that the earth revolves around the sun. But economics is not like physics. Tax policy is something the framers left to politics. And in politics, the facts often matter less than who has the biggest bullhorn.

The same mad men who once ran campaigns featuring doctors extolling the health benefits of smoking are now busy marketing the dogma that tax cuts mean broad prosperity, no matter what the facts show. As millions of Americans prepare to file their annual taxes, they do so in an environment of media-perpetuated tax myths. Here are a few points about taxes and the economy, with figures adjusted for inflation, to consider during this tax season.

1. Poor Americans do pay taxes.

Gretchen Carlson, Fox News host, said last year: "Forty-seven percent of Americans don't pay any taxes." John McCain and Sarah Palin both said similar things during the 2008 campaign, and Ari Fleischer, former Bush White House spokesman, once said that "50 percent of the country gets benefits without paying for them."

Actually, they pay plenty in taxes, just not a lot of federal income taxes.

Data from the Tax Foundation shows that in 2008, the average income for the bottom half of taxpayers was $15,300. This year, the first $9,350 of income for singles and $18,700 for married couples is exempt from taxes—just slightly more than in 2008. That means millions of the poor don't make enough to owe income taxes.

But they still pay plenty of other taxes, including federal payroll taxes. Between gas taxes, sales taxes, utility taxes and other taxes, no one lives tax-free in America.

Additionally, when it comes to state and local taxes, the poor bear a heavier burden than the rich in all 50 states, Citizens for Tax Justice calculated from official data. In Alabama, for example, one-fifth of Alabama families make less than $13,000 but pay almost 11 percent of their income in state and local taxes, compared with less than 4 percent for those who make $229,000 or more.

2. The wealthiest Americans don't carry the burden.

Sen. Rand Paul, the Tea Party favorite, told David Letterman recently that "the wealthy do pay most of the taxes in this country." It's true that the top 1 percent of wage earners paid 38 percent of the federal income taxes in 2008 (the most recent year for which data is available). But people forget that income tax make up less than half of all federal taxes, and only one-fifth of taxes at all levels of government.

Social Security, Medicare and unemployment insurance taxes (known as payroll taxes) are paid mostly by the bottom 90 percent of wage earners. Once one reaches $106,800 of income, Social Security taxes stop rising. Warren Buffett pays the exact same amount of Social Security taxes as one who earns $106,800.

3. In fact, the wealthy are paying less in taxes.

The Internal Revenue Service issues an annual report on the 400 highest income tax payers. In 1961, there were 398 taxpayers who made $1 million or more. I compared their income tax burdens from that year to those in 2007.

Despite skyrocketing incomes, the federal tax burden on the richest 400 has been slashed, thanks to a variety of loopholes, allowable deductions and other tools. The actual share of their income paid in taxes, according to the IRS, is 16.6 percent. Adding payroll taxes barely nudges that number.

Compare that to the vast majority of Americans, whose share of their income going to federal taxes increased from 13.1 percent in 1961 to 22.5 percent in 2007. (Incidentally, during seven of the eight Bush years, the IRS report on the top 400 taxpayers was labeled a state secret, a policy that Obama overturned almost instantly after his inauguration.)

4. Many of the very richest pay no current income taxes at all.

John Paulson, the most successful hedge fund manager of all, bet against the mortgage market one year and then bet with Glenn Beck in the gold market the next. Paulson made himself $9 billion in fees in just two years. His current tax bill on that $9 billion? Zero.

Congress lets hedge fund managers earn all they can now and pay their taxes years from now. In 2007, Congress debated whether hedge fund managers should pay the top tax rate that applies to wages, bonuses and other compensation for their labors, which is 35 percent. That tax rate starts at about $300,000 of taxable income; not even pocket change to Paulson, but almost 12 years of gross pay to the median-wage worker.

The Republicans and a key Democrat, Sen. Charles Schumer of New York, fought successfully to keep the tax rate on hedge fund managers at 15 percent, arguing that the profits from hedge funds should be considered capital gains, not ordinary income, which got a lot of attention in the news.

What the news media missed is that hedge fund managers don't even pay that 15 percent, at least not currently. So long as they leave their money, known as "carried interest," in the hedge fund, their taxes are deferred. They only pay taxes when they cash out, which could be decades from now. How do these hedge fund managers get money in the meantime? By borrowing against the carried interest, often at absurdly low rates, currently about 2 percent.

Lots of other people live tax-free, too. I have Donald Trump's tax records for four years early in his career. He paid no taxes for two of those years. Big real estate investors enjoy tax-free living under a 1993 law President Clinton signed which lets "professional" real estate investors use paper losses like depreciation on their buildings against any cash income—even if they end up with negative incomes, like Trump.

Frank and Jamie McCourt, who own the Los Angeles Dodgers, have not paid any income taxes since at least 2004. Yet they spent $45 million in one year alone. How? They borrowed against Dodger ticket revenue and other assets. To the IRS, they look like paupers.

5. Since Reagan, only the wealthy have gained significant income.

The Heritage Foundation, the Cato Institute and similar conservative marketing organizations tell us relentlessly that lower tax rates will make us all better off.

Since 1980, when President Reagan won the election promising prosperity through tax cuts, the average income of the vast majority—the bottom 90 percent of Americans—has increased just $303, or 1 percent. Put another way, for each dollar people in the vast majority made in 1980, in 2008 their income was up to $1.01.

Those at the top fared far better. The top 1 percent's average income more than doubled to $1.1 million, according to an analysis of tax data by economists Thomas Piketty and Emmanuel Saez. The very wealthy—the top 1/10th of 1 percent—each enjoyed almost four dollars in 2008 for each dollar in 1980.

The top 300,000 Americans now enjoy almost as much income as the bottom 150 million combined.

6. The story is much the same for corporations—less in taxes.

Corporate profits in 2008, the latest year for which data is available, were $1,830 billion, up almost 12 percent from $1,638.7 in 2000. Yet even though corporate tax rates have not been cut, corporate income tax revenues fell to $230 billion from $249 billion—an 8 percent decline, thanks to a number of loopholes. The official 2010 profit numbers are not added up and released by the government, but the amount paid in corporate taxes fell further, to $191 billion, a decline of more than 23 percent compared with 2000.

7. Corporate tax breaks can destroy jobs.

Despite all the noise that America has the world's second highest corporate tax rate, the actual taxes paid by corporations are falling because of a growing number of loopholes and companies shifting profits to tax havens like the Cayman Islands.

Right now, America's corporations are sitting on close to $2 trillion in cash that is not being used to create jobs. Instead, it's acting as an insurance policy for managers unwilling to take the risk of actually building the businesses they are paid so well to run.

A corporate tax rate that is too low actually destroys jobs. That's because a higher tax rate encourages businesses (who don't want to pay taxes) to keep the profits in the business and reinvest, rather than pull them out and have to pay high taxes.

The 2004 American Jobs Creation Act, which passed with bipartisan support, encouraged more than 800 companies to bring profits that were untaxed but overseas back to the United States. But instead of paying the usual 35 percent tax, the companies paid just 5.25 percent.

The companies said bringing the money home—"repatriating" it, they called it—would mean lots of new jobs. Sen. John Ensign, the Nevada Republican, put the figure at 660,000.

Pfizer, the drug company, was the biggest beneficiary. It brought home $37 billion, saving $11 billion in taxes. Almost immediately it started firing people. Since the law took effect, it has let 40,000 workers go. In all, it appears that at least 100,000 jobs were destroyed.

8. Republicans like taxes, too.

President Reagan signed into law 11 tax increases. His administration and the Washington press corps called the increases "revenue enhancers." Among other things, Reagan hiked Social Security taxes so high that the government collected more than $2 trillion in surplus tax since 2008.

George W. Bush signed a tax increase, too, in 2006, despite his written pledge to never raise taxes on anyone. It raised taxes on teenagers by requiring income-earning kids up to age 17 to pay taxes at their parents' tax rate, which would almost always be higher than the rate they would otherwise pay. It was a story that ran buried inside the New York Times one Sunday, but nowhere else.

In fact, thanks to Republicans, one in three Americans will pay higher taxes this year than they did last year.

First, some history. In 2009, President Obama pushed his own tax cut—for the working class. He persuaded Congress to enact the Making Work Pay Tax Credit. Over the two years 2009 and 2010, it saved single workers up to $800 and married heterosexual couples up to $1,600, even if only one spouse worked. The top 5 percent or so of taxpayers were denied this tax break.

The Obama administration called it "the biggest middle-class tax cut" ever. Yet last December, the Republicans, back in control of the House of Representatives, killed Obama's Making Work Pay Credit while extending the Bush tax cuts for two more years, a policy Obama acquiesced to. By doing so, congressional Republican leaders actually increased taxes on one-third of Americans this year, all of them the working poor.

As a result, of the 155 million households in the tax system, 51 million will pay an average of $129 more in taxes this year. That's $6.6 billion in higher taxes for the working poor, the nonpartisan Tax Policy Center estimates.

In addition, the Republicans changed the rate of workers' FICA contributions, which finances half of Social Security. The result: the top 5 percent, people who make more than $106,800, will save $2,136, and two-career couples will save $4,272.

9. Other countries do it better.

We measure our economic progress in terms of a crude measure known as gross domestic product. The way the official statistics are put together, each dollar spent on solar energy equipment counts the same as each dollar spent investigating murders. We do not give any measure of value to time spent rearing children or growing our own vegetables or to time off for leisure and community service. We also don't measure the economic damage caused by shock, such as losing a job, which means not only loss of income and depletion of savings but loss of health insurance, which a Harvard Medical School study found results in 45,000 unnecessary deaths each year.

Compare this to Germany, one of many countries with a smarter tax system and smarter spending policies. Germans work less, make more per hour and get much better parental leave than Americans, many of whom get no benefits such as healthcare, pensions or even a retirement savings plan. To achieve this, German workers on average pay 52 percent of their income in taxes.

At first blush, the German tax burden seems horrendous. But in Germany—as well as Britain, France, Scandinavia, Canada, Australia and Japan—tax-supported institutions provide many of the things Americans pay for with after-tax dollars. And buying wholesale rather than retail saves money.

A proper comparison would take the 30 percent average tax on American workers, add their out-of-pocket spending on healthcare, college tuition and fees for services, and compare it to taxes that the average German pays. Add it all up, and the combination of tax and personal spending is roughly equal in both countries, but with a large risk of catastrophic loss in America, but only a tiny risk in Germany.

Americans take on $85 billion of debt each year for higher education, while college is financed by taxes in Germany and tuition is cheap to free in other modern countries. While soaring medical costs are a key reason that, since 1980, bankruptcy in America has increased 15 times faster than population growth, no one in Germany or many other parts of the modern world goes broke because of accident or illness.

On the corporate tax side, the Germans encourage reinvestment at home, and German rules tightly control accounting so that profits earned at home cannot be made to appear as profits earned in tax havens.

Adopting the German system is not the answer for America. But crafting a tax system that benefits the vast majority, reduces risks, provides universal healthcare and focuses on diplomacy rather than militarism would be a lot smarter than what we have now.

We started down this road with Reagan's election in 1980 and upped the ante in this century with George W. Bush. How long does it take to conclude that a policy has failed to fulfill its promises?

And as we think of that, keep in mind George Washington. When he fell ill, his doctors followed the common wisdom of the era: they cut him and bled him to remove bad blood. As Washington's condition grew worse, he was bled even more. And like the mantra of tax cuts for the rich, the same treatment continued to be applied until he was killed.

Luckily, we don't bleed the sick anymore. But we are bleeding our government to death.

David Cay Johnston is a Pulitzer-winning columnist who has been called the 'de facto chief tax enforcement officer of the United States' for his reporting in the 'New York Times,' which has shut down many tax dodges and schemes. He currently writes for Tax.com, teaches the tax, property and regulatory law of the ancient world at Syracuse University College of Law and Whitman School of Management, and is finishing his latest book, 'The Fine Print.'

Send a letter to the editor about this story.

|

|

|

|

|

|