home | metro silicon valley index | the arts | books | review

Meltdown

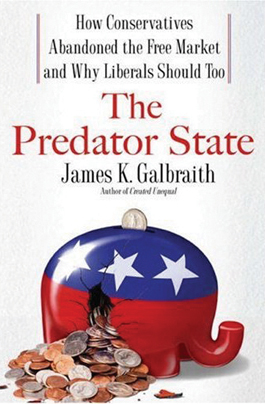

Economist James Galbraith shows how conservatives engineered financial free-fall

Reviewed by John Sakowicz

AS LIFE as we know it seemed to be ending—bailouts pushing $1 trillion on Wall Street, the stock market plunging, credit markets seized up around the world, with banks even refusing to lend to each other, never mind lending to their customers—James Galbraith and I talked. In his recent book, The Predator State, James Galbraith does what his famous father, John Kenneth Galbraith, never did: he makes a moral case. He argues that our country has been hijacked by the neoconservatives of the Bush administration. The "ideals" extolled by those neoconservatives—free trade, monetarism, balanced budgets, deregulation, privatization—are nothing more than a bunch of bull, says Galbraith. Moreover, he says, their true agenda was always greed. Taken together, these "ideals" came to represent a worldview whose basic principle was largely unchallenged by liberals. And what was that basic principle? Socialism—socialism for the rich.

During the last decade, the United States has become a nation of predators vs. the rest of us. As Galbraith explains it, neoconservatives in Washington and on Wall Street have conspired to steal elections and occupy the most powerful political and financial institutions in the land so that they might abuse that power. How does it work? When times are good, extol the virtues of privatization. Then reward politicians for betraying the public trust. Finally, let the robber barons rob the country blind. When times are bad, extol the virtues of socialism. Say you're asking for bailouts not for yourself but for the greater good. Nationalize whole industries, like the financial sector, whatever the cost.

Here's a quick economics lesson from Galbraith: Wall Street reinvented itself after the Glass-Steagall Act (which instituted banking controls in the Depression) was repealed in 1999. Then-Sen. Phil Gramm proceeded to deregulate every damn market you can think of: stocks, bonds, commodities, etc. Every form of debt was also "securitized" in exotic financial instruments like CMOs, CDOs and SIVs (like many military acronyms, these acronyms are innocent-sounding names for things that are harmful). Eventually, a newfangled market called swaps and derivatives was ushered in, a market that has a notional value in the hundreds of trillions of dollars—a market as esoteric as it is unregulated. Think of it as make-believe money that made very real people really, really rich. Printing this make-believe money on Wall Street was a new species of bankers called "prime brokers."

Things were good until last summer, when Bear Stearns went bust. Then things turned bad because those really, really rich people went crazy speculating in make-believe money at the encouragement of prime brokers—and at the encouragement of the banks and broker dealers the prime brokers worked for. Words like "value" and "risk" became meaningless. Something had to give. Banks and broker dealers started going bust. First, one by one, then, in waves. But those really, really rich people were allowed to keep their money. A funny thing happened at the same time, too. Those very same ruthless capitalist archetypes became hypocrites. "We're too big to fail," they hollered. "You've got to save the rich to save the poor."

Don't call them neoconservatives or conservative anything, says Galbraith. Call them by their true name: predators. And Galbraith continues, predators are almost entirely responsible for the problems confronting us at this moment in history: the subprime crisis, our new national debt ceiling of 14 digits; the deepening divide between the rich and the poor; the still-persistent inequality across the spectrum of race, gender and immigration status; climate change; our collapsing bridges and other infrastructure deficit; and, last but not least, the falling dollar.

What can America do to save itself? Simple, says Galbraith. Bring back the real ideology of free markets. If Fannie or Freddie have to fail, let them fail. New mortgage guarantors will spring up. When you think about it, Fannie and Freddie were just in the insurance business, plain and simple. The market will recover. Have faith. Also, start repairing government. Publicly finance campaigns and elections. Send the lobbyists packing. Finally, start regulating again. Regulate the new Wall Street—its new products, i.e., swaps and derivatives, and its new services, i.e., prime brokerage. Robber barons cannot be expected to police themselves. And for God's sake, stop labeling yourself and others as "liberals" or "conservatives." Those labels are meaningless. There's only the super-rich and the rest of us. There's only predators and prey.

THE PREDATOR STATE by James Galbraith; Free Press; 240 pages; $25 hardback. John Sakowicz is the co-founder of the hedge fund Battle Mountain Research Group. He can be seen in action at www.ukiahvalley.tv. Araianna Carisella assisted with research for this article.

Send a letter to the editor about this story.

|

|

|

|

|

|