Cashing in Their Chips

There may be life in work for Charles Shussett, but there is also death. And a nice chunk of change.

By Cecily Barnes

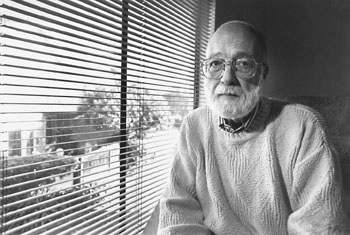

Apart from his bright magenta sweater, the only colorful thing about 66-year-old Charles Shussett is the glint in his eye when he talks about investments.

"There's life in work for you, honey," Shussett's sweet and amicable wife, Elaine, cuts in. "Even his doctor says so," she assures me.

Sitting in his tiny office in the corner of his Saratoga townhouse, Shussett positively lights up when I ask him what sort of investments he recommends to his clients.

"I steer people to the right type of investment for their situation, doing the planning that most people don't do," he explains, enjoying taking his time getting around to the point.

"Chuck loves to protect people," Elaine adds.

However, Shussett's latest investment option seems less than philanthropic, at least at first. Among a host of other investment possibilities, Shussett offers his clients viatical settlements, or life insurance policies purchased at resale values. Essentially, the sick and dying, largely AIDS patients, sell off their life insurance policies for less than they are worth to viatical companies, who are in the business of buying and selling such policies. While Shussett admits the practice seems ghoulish, he says the investment is a charitable one. And a 1997 tax law that protects some viatical settlements from Uncle Sam's outstretched hand makes it a mighty good investment, too.

"Some people would probably be averse to it, but, really, you're doing everyone a big favor," Shussett explains from behind his large wooden desk. "Investors, they get a big rate of return, and you're doing a big favor to the patients."

Shussett hands me a stack of letters from AIDS patients previously involved in such exchanges, thanking the viatical companies and investors for allowing them access to their life-insurance money--and a better quality of life in their final months.

Money which would have proven useless to them once dead instead goes into their pockets while they're still alive, helping to pay medical bills and other expenses.

And the investors cash in when the patients cash out. While this practice may liken Shussett to the Grim Reaper, everyone involved claims the whole business is a win-win situation, so long as the viatical companies are kept in check and don't start skimming off unethical amounts of profit.

"I would say it's pretty positive, but it's important to have a benefits counselor assist in the process because there are companies out there that are unscrupulous," said JoAnne Keatley, a benefits counselor from the AIDS Project. "I advise my clients to always go with licensed viatical companies."

There are presently at least 24 licensed viatical companies in California. In addition to these, there are unscrupulous and unlicensed viatical companies with the potential to rip off AIDS patients lacking sound business sense, warns Norm Robinson, executive director of AIDS Resources, Information and Services (ARIS).

"They can be really taken advantage of if the viatical company is an unscrupulous one," Robinson says. "You can have a $100,000 policy and only get $60,000."

The amount of money a patient receives on a policy depends upon how long doctors speculate they'll tie up the investment--or, in other words, live. The lucrative AIDS patient, for example, with a T-cell count below 100, one or more opportunistic infections and frequent hospitalizations can collect 88 percent of a life insurance policy. The more healthy terminal patients aren't worth quite as much, collecting sometimes as little as 58 percent on their policies.

"The longer you have to live, the less they'll pay you," Robinson explains. "It's all a bit of a gamble about somebody's life span."

But even Robinson admits that cashing in on life insurance policies offers terminally ill patients an option where no other exists.

The viatical company Mutual Benefits pulls on investors' financial heartstrings, reiterating in its sales literature that the investment is not only profitable and sound, but humanitarian, too. What could be better?

"For those of you with a heart of compassion," Mutual Benefits' brochure reads, "participating in this unique program goes beyond the everyday investment. Your rewards are both humanitarian and financial."

Agreeing that the investment is charitable, Shussett proposes the option to his clients.

"It's humane," he assures. "You can help people who really don't have any other source of income."

Shussett admits, however, that he is happy to deal only with investors.

"Fortunately, I'm not looking for people looking to sell their policies," he remarks. "Can you imagine going to someone and saying, 'When do you think you're going to die?' "

[ Metro | Metroactive Central | Archives ]

This page was designed and created by the Boulevards team.

From the January 23-19, 1997 issue of Metro

Copyright © 1997 Metro Publishing, Inc.

![[Metroactive Features]](/features/gifs/feat468.gif)