![[Metroactive Features]](/features/gifs/feat468.gif)

[ Features Index | Metro | Metroactive Central | Archives ]

Power Brokers

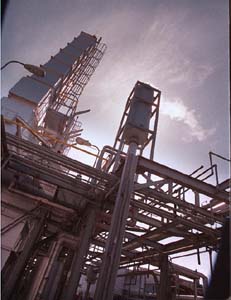

Megawatts for the Masses: Santa Clara's city-owned electric company, Silicon Valley Power, beats PG&E for service and cost, producing electricity at plants like this local natural-gas-fired generator.

Megawatts for the Masses: Santa Clara's city-owned electric company, Silicon Valley Power, beats PG&E for service and cost, producing electricity at plants like this local natural-gas-fired generator.Christopher Gardner

Santa Clara's 100-year-old public utility outperforms PG&E. The city's high-octane electricity traders can handle Mother Nature, but will they be able to handle the free market? By Jim Rendon AT 7AM, THE STREET OUTSIDE a two-story stucco office building off El Camino Real in Santa Clara is nearly empty. Only a handful of cars are clustered in the building's lot, huddled like cattle against the morning mist. But in a room on the building's second story, action is peaking. Phones ring. Three men in worn khakis and short-sleeve shirts talk into headsets, fielding calls, scribbling on pads, reading spreadsheets on monitors. Steve Hance puts his headset call on hold and grabs for one of the ringing phones on his desk. "Hey, Sean ... I mean Andrew," he stumbles, confusing the broker he just put on hold with the broker he's got on the line. "The trade at $1.70 might be bogus. They were just trying to draw somebody up. Follow the PV and South Path 15," he says, before slamming the phone back on the hook. He glances at the live Reuters feed displayed on an adjacent monitor where a graph plots the day's market trend--a quick upsurge around 7:15, then just a few dozen minutes later, it turns back down. Someone was just trying to sell to themselves to create some movement in the market, Hance says, explaining his call. Without anything to push it, the market can get sluggish, and without movement, there is no opportunity to make money. And making money is why Hance is here. Hance and the others, animated by coffee and market-driven adrenaline, are not investors day-trading their vacation funds. These early-morning traders are riding market trends with the city of Santa Clara's resources, putting tens of thousands of dollars and city-generated power on the line at a shot. All the traders in the room work for Silicon Valley Power, the electric company owned by the citizens of Santa Clara and run not by a board of directors but by the City Council.

Santa Clara is one of a dozen cities in California that run their own utility, escaping the electricity giants like PG&E. Rather than focusing on Founded more than a hundred years ago, Santa Clara's public utility, one of 2,000 in the United States, has been pushed to change by the recent deregulation of the utility market. The law allows a city council to determine whether to allow competition with its municipally owned utility, which would also allow the utility to expand its customer base outside the city limits. It looks as if Santa Clara will open its doors to competition in 2000. In preparation for the slew of nimble private-sector companies already eyeing the market, the utility is rapidly cutting costs and working the market to pay down its sizable debt from the 1980s. When the time comes, these companies will have to compete with a public utility already vastly underselling PG&E. According to a study commissioned by Silicon Valley Power, residential prices are 40 percent below PG&E's. But the residential accounts aren't what outside power suppliers are salivating over. The city-owned utility does 85 percent of its business with some of the world's largest high-tech manufacturers: Intel, Sun Microsystems, 3Com and National Semiconductor all buy electricity from Silicon Valley Power. Chip Generator IN AN AIRY ROOM with high ceilings and two banks of computer monitors, Maureen Linder looks up at a wall-size map of Santa Clara. Streets, housing lots and utility lines are traced out across the wall. Scattered across the map are logos for some of the valley's most recognizable tech companies, as well as that of another massive power consumer: Great America. "Sometimes we have to scramble to find someone's logo when we're bringing them on a tour," Linder jokes. As a customer service representative, she works with some of the agency's largest customers, making sure that supersensitive chip manufacturers get high-quality power without any surges. If power goes out, she can be on the phone in the middle of the night, getting information to corporate customers about problems. All the effort seems to be paying off. "Their service is so good, we paid to extend their network," says Mike Brozda, a spokesman with National Semiconductor, whose plant sits in both Sunnyvale and Santa Clara. Rather than split the building's power between PG&E and Silicon Valley Power, the company extended Santa Clara's power lines into Sunnyvale at its own expense. Santa Clara's power is cheaper than PG&E, says Dan Hoffman, a facilities manager with 3Com. "They're able to offer similar service [to PG&E] without as much red tape," he says. Both customers say the specter of competition has pushed the utility to improve its service. California's electric utility restructuring also created a new wholesale electricity market, opening up new moneymaking opportunities. "Five years ago when you bought power, the paperwork took a month. It took a week to negotiate the price. Now it takes seconds to make a buy," says Hance, the city's lead power trader. Playing that market and winning against the Harvard M.B.A.s at Morgan Stanley has proved lucrative for the city. They are ahead of their annual $5 million target, says Chris Cervelli, who manages the trading room. "None of these guys are M.B.A.s," Cervelli says. "They know the industry, they've got street smarts--that's what it takes to play this market." Street smarts and an eye for the weather.

Watt Warrior: Noel DeGroof schedules electricity coming in from city-owned generators and the Wall Street-style trades made by his colleagues. Watts the Frequency? JUST BEFORE 5:30am, Hance pulls into the parking lot here. His cell phone is still warm from talking with brokers in Houston during the drive. Once in the office, he clicks on the TV mounted on the wall above the small pod of desks. Soaking in the low hum of Muzak on the Weather Channel, Hance starts up the coffeepot. Weather, he explains, can be the biggest indicator of where prices are going. Heat in the South means more power will be used and the market can climb. Warm spring weather in the Pacific Northwest can mean heavy snow melt, which increases flow on the Columbia River, glutting the market with power, sending prices plummeting. Outages or transmission problems can also drive the market. Five years ago, there were only a few generators to buy from. Today there are nearly a hundred marketers trading power on the California Power Exchange. Sometimes energy can pass through five or six different hands before someone actually decides to hold onto the purchase and use it. While municipally owned utilities make up a small percentage of all the activity in the market, the small unit of three traders and the back office staff at Silicon Valley Power do more trading than any other municipally owned electric company in the country. The city trades a lot, in part, because it generates so much electricity. The utility is $900 million in debt from the generating and transmission facilities it purchased in the 1980s--a move that landed it rare self-sufficiency for a public utility. Unlike PG&E, which can sell stock to generate capital, Santa Clara had to go into debt to pay for its four hydroelectric plants in the Sierra and its stake in geothermal plants and other hydroelectric projects as well as local natural-gas-fired plants. It also has a stake in a coal plant in New Mexico and in transmission lines coming over the border from Oregon and Arizona. Preparing to compete on an open power market, Silicon Valley Power has frozen prices through 2002 and plans to cut rates by 30 percent to 40 percent. That plan is being subsidized in part by money made on the market, selling its power, buying cheaper power when it can, buying and selling future options and making short-term buys on upward trends like fevered day traders. A $1 move of the market can mean big income. But there is also risk. "I remember the first day I had a big loss," Hance says. "I lost $80,000." The market was high, so he sold 120 megawatts of city power for a tidy profit. Then the unexpected happened. A plane crashed into transmission wires, cutting the supply short and driving the price even higher. He was forced to buy back the power at more than twice what he sold it for. "At 3am I was lying in bed staring at the ceiling, asking myself, What did I do?" he says. "But you have days like that. You learn to not let it affect you psychologically." Power Exchange BY ITS NATURE, the market is risky, says Dave Penn, deputy director of the American Public Power Association, which represents municipally owned utilities. "Louisville Gas and Electric and Pacific Power and Light, respected firms, both lost their shirts in a weekend's worth of trading activity last June. Public utilities have to be careful to not push things too far," he says. All of the traders at Silicon Valley Power are well aware of the market's downside. "If the market goes down, you have to get out. If it goes down when you think it should go up, you are wrong. You get good at admitting when you are wrong. If you can't do that, you are in the wrong business," Hance says.

But for all its profit potential, the market may have an unintended Environmentalists who have long fought against nuclear power and pushed for the phase-out of coal worry that these heavily subsidized industries could come to dominate the market. When price is the only indicator, inexpensive commodities can easily take over. "Coal is cheaper than dirt," says Rich Ferguson, an energy expert with Sierra Club California. And that makes electricity from coal-fired plants a bargain. However, he and others say the market is too young to determine what its effect will be on green power or even on prices. But Ferguson says the market is helpful in one way. "For the first time we know what the value of power is at any hour of any day." That gives conservation a market value as well. The real strength of public utilities, he says, is that they allow more citizen control than a corporate giant like PG&E. "Environmentalists like the publicly owned format," he says. "It gives us a public forum to go to and make an argument that the utility shouldn't build a dirty plant." While Penn says local control draws communities to local utilities, the trend in the industry is toward consolidation. More and more mergers are consolidating shareholder-owned utilities. Now, Penn says, customers in Utah need to call Scotland to complain because the shareholder-owned utility in that region was bought out this past year. While there have been few new additions to the public power association in the past two decades, Penn says that nationally more than 150 communities are studying the possibility of municipally owned power companies. Palo Alto has a municipal utility, San Francisco has undertaken studies to look at buying out PG&E, and Long Beach is on the cusp of creating a new municipal utility. "We're getting lots of calls," Penn says. "Suddenly people are getting more interested in local control." [ San Jose | Metroactive Central | Archives ]

|

From the May 20-26, 1999 issue of Metro.

Copyright © Metro Publishing Inc. Maintained by Boulevards New Media.

Christopher Gardner

Christopher Gardner